For this entry, I’ll try to explain the basic accounting equation in relation to debit-credit.

First, I’m going to define the basic definition, which basically state that for a given business entity, the basic accounting equation is:

Claims on Assets define the claims on every item of the Asset. For example, capital is an item that is known to be assigned to the owner, while payables are claims of others against an Asset. By definition, this side is placed at the right side of the Accounting equation known as credit side.

Liabilities are items owed, they are normally items that were borrowed from other businesses that must be covered or paid sometime in the future.

Owner’s Equity are items belonging to the owner of the business. They are items such as money, equipment, etc that are/were added by the owner to the business.

Example:

1) Mark invested money into the business, worth $25,000.

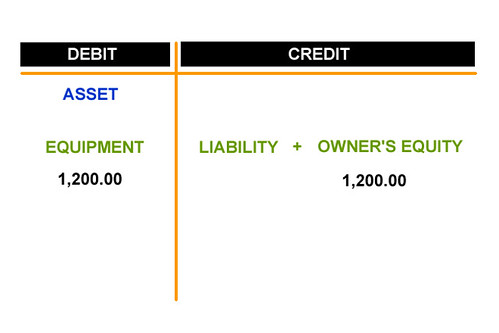

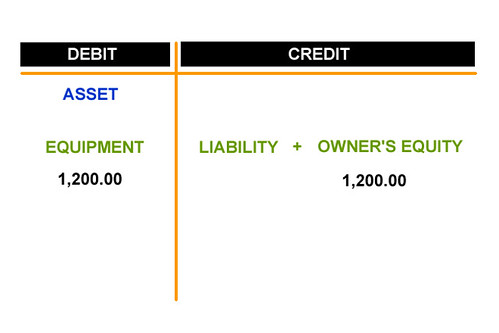

2) Mark added office equipment, by adding his personal laptop computer worth $1,200.

Assets = Liabilities + Owner’s Equity

And is derived from:

assets = claims on assets

Assets are items that have monetary value and are owned by the business. By definition, Assets are placed on the left side of the Accounting equation. A term has been assigned describing the left side, known as debit.Claims on Assets define the claims on every item of the Asset. For example, capital is an item that is known to be assigned to the owner, while payables are claims of others against an Asset. By definition, this side is placed at the right side of the Accounting equation known as credit side.

debit = credit

The equation above has the following meanings:

- The left side is denoted by the term debit.

- The right side is denoted by the term credit.

- The two sides of the equation are equal.

assets = debit

In our basic accounting equation, the element known as Asset is assigned to debit. The equation shown above simply means that all assets are placed on the debit side, left side of the basic accounting equation.

claims on assets = credit

On the right side of the basic accounting equation, we find credit. This simply means that all claims on assets are to be placed on the right side of the equation, known as credit side. To illustrate it, we state claims on assets is equal to credit.

Secondly, At this point, the term Claims on Assets will be covered in detail, showing the two parts. The credit side of the equation has two items, namely: Liabilities and Owner’s Equity.Liabilities are items owed, they are normally items that were borrowed from other businesses that must be covered or paid sometime in the future.

Owner’s Equity are items belonging to the owner of the business. They are items such as money, equipment, etc that are/were added by the owner to the business.

Example:

1) Mark invested money into the business, worth $25,000.

2) Mark added office equipment, by adding his personal laptop computer worth $1,200.

No comments:

Post a Comment