ACCOUNTING FOR INVENTORIES:

International Accounting Standard (IAS) 2

This standard is established for providing proper guidance for determining the cost of inventories involved in a business. It provides the information for treating inventories basically at two levels.

- when the inventory is purchased by the business and its treatment and recording when it is entered in the business.

- when the inventory is recorded and treated as an expense for the business.

Inventories:

The raw material, work in progress goods and finished goods are treated as inventory for a business. As these are ready for sale or will be ready for sale in future and treated as asset of a business.

---> Work in progress which is under construction, biological instruments and shares and bonds are not included in inventory of business entity.

Objectives:

The main objectives of IAS 2 are as follows;

- guidance for cost evaluation.

- accounting treatment for the inventories of business.

- circumstances for written down and net realizable values.

- cost which is to be recognized

- how to carry forward cost till the revenues are generated

Measurement of Inventories:

There are basically two approaches for inventories:

1. Perpetual inventory system.

2. Periodic inventory system.

-->Both systems were widely used.The use of computerized accounting system has made perpetual inventory system easy and cost-effective.

-->Periodic approach is used primarily by very small businesses with manual accounting systems.

--> When an inventory is purchased, it is recorded as an asset in the balance sheet. When it is sold to customers, the asset is converted into an expense, that is the cost of goods sold.

PERPETUAL INVENTORY SYSTEM:

In a perpetual inventory system, transactions involving costs of inventory are recorded immediately as they occur.

--> This system is known as perpetual accounting system because of the fact that the accounting records are kept perpetually up-to-date.

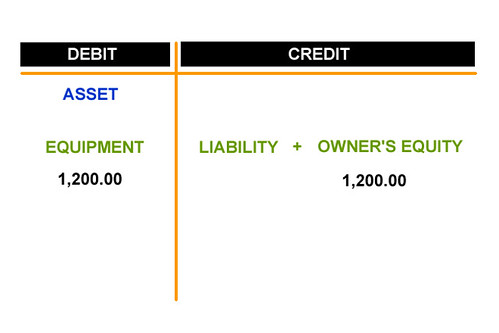

--> Purchases of inventory are recorded as debit in an asset account named inventory.

-->When merchandize is sold, two entries are recorded:

- one to recognize the revenue earned.

- second to recognize the related cost of goods sold.The second entry also reduces the balance of inventory account to show that the sale of some of the inventory.

PERIODIC INVENTORY SYSTEM:

A periodic inventory system is opposite to a perpetual inventory system.

--> In a periodic inventory system, no effort is made to keep up-to-date records of the inventory and the cost of goods sold.

--> These amounts are determined only periodically usually at the end of each year.