Since there are timing differences between when data is entered in the banks systems and when data is entered in the individual's system, there is sometimes a normal discrepancy between account balances. The goal of reconciliation is to determine if the discrepancy is due to error rather than timing.

Friday 30 December 2011

Sunday 4 December 2011

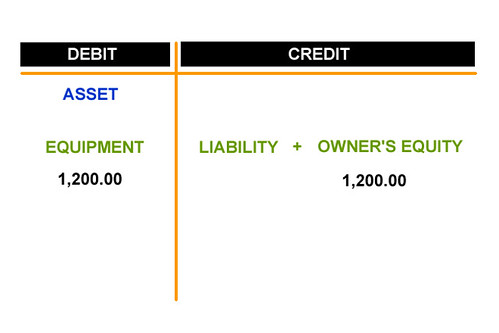

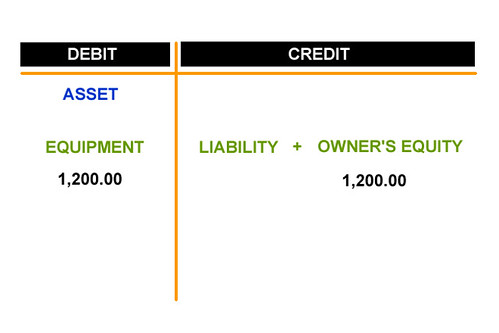

DEBIT CREDIT, BASIC ACCOUNTING EQUATION

For this entry, I’ll try to explain the basic accounting equation in relation to debit-credit.

First, I’m going to define the basic definition, which basically state that for a given business entity, the basic accounting equation is:

Claims on Assets define the claims on every item of the Asset. For example, capital is an item that is known to be assigned to the owner, while payables are claims of others against an Asset. By definition, this side is placed at the right side of the Accounting equation known as credit side.

Liabilities are items owed, they are normally items that were borrowed from other businesses that must be covered or paid sometime in the future.

Owner’s Equity are items belonging to the owner of the business. They are items such as money, equipment, etc that are/were added by the owner to the business.

Example:

1) Mark invested money into the business, worth $25,000.

2) Mark added office equipment, by adding his personal laptop computer worth $1,200.

Assets = Liabilities + Owner’s Equity

And is derived from:

assets = claims on assets

Assets are items that have monetary value and are owned by the business. By definition, Assets are placed on the left side of the Accounting equation. A term has been assigned describing the left side, known as debit.Claims on Assets define the claims on every item of the Asset. For example, capital is an item that is known to be assigned to the owner, while payables are claims of others against an Asset. By definition, this side is placed at the right side of the Accounting equation known as credit side.

debit = credit

The equation above has the following meanings:

- The left side is denoted by the term debit.

- The right side is denoted by the term credit.

- The two sides of the equation are equal.

assets = debit

In our basic accounting equation, the element known as Asset is assigned to debit. The equation shown above simply means that all assets are placed on the debit side, left side of the basic accounting equation.

claims on assets = credit

On the right side of the basic accounting equation, we find credit. This simply means that all claims on assets are to be placed on the right side of the equation, known as credit side. To illustrate it, we state claims on assets is equal to credit.

Secondly, At this point, the term Claims on Assets will be covered in detail, showing the two parts. The credit side of the equation has two items, namely: Liabilities and Owner’s Equity.Liabilities are items owed, they are normally items that were borrowed from other businesses that must be covered or paid sometime in the future.

Owner’s Equity are items belonging to the owner of the business. They are items such as money, equipment, etc that are/were added by the owner to the business.

Example:

1) Mark invested money into the business, worth $25,000.

2) Mark added office equipment, by adding his personal laptop computer worth $1,200.

Thursday 17 November 2011

ADUSTING ENTRIES SOLUTION CRITICAL THINKING CASE# 4.1

a. On September 1,received advance payment from a shopping centre for property managment services to be performed over the three months period begining Septmeber 1. The entire amount received was credited to our revenue account?

ANS. No adjusting entry is needed, because although the revenue was collected in advance on September 1, it has all been earned prior to year-end. Thus, inclusion of the entire amount in revenue of the period is correct.

b. On December 1 received advance payment from the same customer described in parts a services to be rendered over the three months period begining December 1. This time, the entire amount recived was credited to unearned revenue account?

ANS. Three month's revenue was collected in advance on December 1 and was credited to an unearned revenue account. At December 31, an adjusting entry is needed to recognize that one-third of this advance payment that has now been earned as revenue. The effects of this adjusting entry will be to reduce a liability (unearned revenue) and increase revenue recognized as earned in the period. Of course, recognizing revenue also increases owners’ equity.

c. Rendered managment seervices for many customers in December. Normal procedure is to record revenue on the date the customer is build, which is early in the month after the services have been rendered?

ANS. As we know the customers are billed after the services are rendered. So an adjusting entry is required to record the amount of services rendered in December 2009.The effect of this adjusting entry would be an increase in asset,increase in revenue earned during this period and an increase in owner's equity

d. On December 15, made full payment for a one year insurance policy that goes into effect on January 2, 2010. The cost of the policy was debited to unexpired insurance?

ANS. No adjusting entry is required because the insurance will go into effect on January 02, 2010.And no benefit has been derived from the asset.So no insurance expense will be recorded on December 2009.

e. Numerous purchasis of equipment were to debited to asset accounts, rather then to expence account?

ANS. An adjusting entry is required because the depreciation on equipment is required to be recorded on December 2009.The effect of this would be an increase in expense,decrease in asset and decrease in Owner's equity.

f. Payroll expence is recorded when employees are payed. Payday for the last two weeks of December fall on January 2, 2010?

ANS. An adjusting entry is required for the amount of salaries for December 2009, because the salaries of this month are due on Janauary 02,2010.The effect of this adjusting entry would be an increase in expense , increase in liability and decrease in owner's equity.

Tuesday 15 November 2011

Peachtree - Maintain Charts of Accounts

General Ledger

Now you have setup your company in Peachtree, it is recommended to establish Chart of accounts, General Ledger Defaults and Beginning Balance if any.

To establish the charts of accounts click the Maintains menu and select “Chart of Accounts...”

The following window will displayed

Here you have to type Account ID, Description and the most Important Account Type.

Enter an account ID and description for the account. The account ID determines how the account is identified and sorted in the chart of accounts list and the General ledger account is displayed as typed in description. Most charts of accounts are set up with specific account types grouped together.

Account Types

Account types define how the account will be grouped in reports and financial statements. They also control what happens during fiscal year-end.

General Ledger accounts are assigned types on the General tab of the Maintain Chart of Accounts window. Select an account type from the drop-down list and select Save to save the account. The account type should be selected carefully. If you are entering a Revenue account then its type will be Income so on. A simplified chart of account with Account ID, Description and Account Type is given at the end of the chapter.

You can enter the Beginning Balances on the General tab. Select the Beginning Balances button. Peachtree displays the Select Period window.

Select the period in which you want to enter beginning balances. You can select from previous, current, or future periods.

Select OK. Peachtree displays the Chart of Accounts Beginning Balances window.

Click or tab to any of the white cells in the grid to add an amount. (The gray cells are for viewing purposes only.)

Enter all the beginning balances for the accounts. Scroll the list box to make sure the account amounts are correct.

If you are out of balance in the Beginning Balances for General Ledger Accounts window, Peachtree displays a warning message indicating that an equity account will be created (or updated) to contain the difference or out-of-balance amount.

This account will be named Beginning Balance Equity, and its type is Equity-Doesn't Close. This account does not appear in the Beginning Balances window, but it will appear in the list of accounts and on financial statements and general ledger reports.

Try to find the reason for the out-of-balance situation, and correct it if possible. (Select Cancel when Peachtree displays the warning message.) If you are entering beginning balances from financial statements supplied by your previous accounting system or by your accountant, you most likely made an error in data entry. Make sure you didn't leave out an account or balance and that you entered all amounts correctly.

When done close the window.

Add a New Account in G/L Beginning Balances

In the Beginning Balances window accessed from the Maintain Chart of Accounts window, select the New button. Peachtree displays the Enter New Account window.

Enter an account ID and description for the account and also chose the appropriate account type and select OK.

Delete an Account from the Chart of Accounts

In order to delete an account from the chart of accounts, there must be no transactions posted to the general ledger that reference the account ID. If an account has a nonzero balance, you must delete or remove transactions associated with it. These can include beginning-balance entries.

If an account has a nonzero balance, you can enter an adjusting G/L transaction in the General Journal to bring the account's balance to zero. Then, after two year-end closings, you can purge or delete the account.

To make the account inactive

You can make the account inactive to ensure that no further transactions are associated with it. Then after two year-end closings, you can purge the account.

From the Maintain menu, select Chart of Accounts. Peachtree displays the Maintain Chart of Accounts window.

Select the account you want to make inactive. To display a list of existing accounts, type ? in the G/L Account ID field, or select the Lookup button.

Select the Inactive check box to the right of the account ID. (There is an mark in the check box when it is selected.)

Subscribe to:

Posts (Atom)